Certified MINISTRY OF CORPORATE AFFAIRS

Letter Details:

- Issued by: Registrar of Companies, CRC Manesar, Ministry of Corporate Affairs, Government of India

- Address: Plot No. 6,7,8, Sector 5, IMT Manesar, District Gurgaon, Haryana, 122050, India

- Date: 13/07/2023

Subject:

- Availability of Name: YOGENDRA SANGALE SOCIAL FOUNDATION

- Reference to Application dated 11/07/2023 (SRNAA3407965).

Main Topics:

- Name Availability

- Registration Validity

- Compliance for NBFCs

- Declaration Requirements

- Penalties for Inappropriate Names

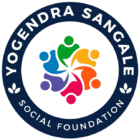

Honored with e-PAN Card by Income Tax Department

Yogendra Sangale Social Foundation is thrilled to announce a significant milestone in its journey towards excellence and recognition. Recently, the Income Tax Department, Government of India, bestowed upon us the prestigious e-Permanent Account Number (e-PAN) Card, bearing the unique alphanumeric code AABCY7107L.

Important Points:

Streamlining Financial Operations

Mandatory Quoting of PAN

Adhering to Legal Norms

Utilizing Enhanced QR Code Technology

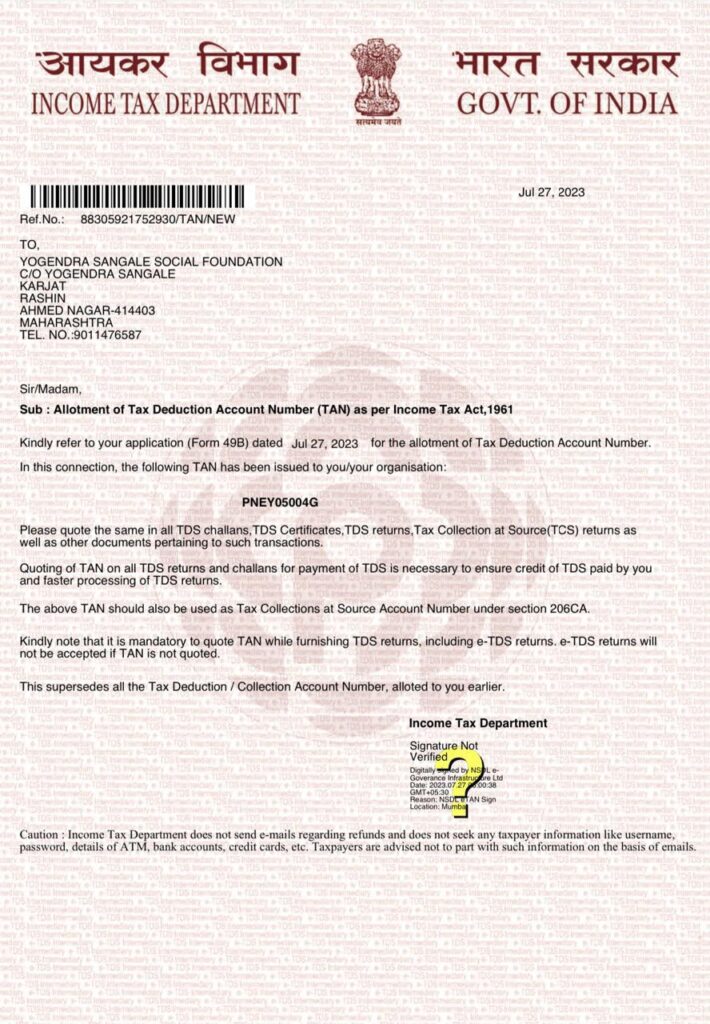

Tax Deduction Account Number (TAN) for Yogendra Sangale Social Foundation

Yogendra Sangale Social Foundation, a beacon of change in Maharashtra, recently received a significant document from the Income Tax Department, bearing the much-awaited Tax Deduction Account Number (TAN).

Importance of TAN for Yogendra Sangale Social Foundation

Legal Compliance: With the allotment of TAN, the foundation aligns itself with the legal obligations outlined in the Income Tax Act, 1961, ensuring adherence to taxation norms set by the Indian government.

Smooth Tax Processing: Quoting TAN on all TDS challans, certificates, and returns facilitates seamless processing of tax transactions, expediting refunds and reducing procedural hassles.

Enhanced Credibility: Possession of a TAN enhances the credibility of the foundation, signaling its commitment to transparency and regulatory compliance, thereby fostering trust among stakeholders.

FORM No. 10AC

Form No. 10AC is a document used in India for reporting the audit findings and financial details of charitable or religious trusts or institutions. This form is specifically designed for entities seeking tax exemptions under section 11(1)(a) of the Income Tax Act, 1961. It serves as a declaration of the income and expenditure incurred by these organizations for charitable or religious purposes.

e-MOA (e-Memorandum of Association) Report

Memorandum of association of the company deals with all aspects of that particular organisation such as the operations delegation of duties and policies, principles, etc. The memorandum of association of any company is formed or designed by considering the objective of a particular firm. In the year 2013, section 399 of the companies act, designed to form an MOA, which is the public document and needs to get aware of this moa to all employees of an organisation.

e-AOA (e-Articles of Association) Report

The Articles of Association (AOA), often referred to as the company’s “rule book,” serve as a comprehensive guide outlining the regulations and objectives that govern the company. These regulations are crucial to ensure smooth operations and adherence to established protocols.

According to Section 2(5) of the Companies Act, 2013, the Articles of Association are defined as:

“The Articles of Association (AOA) of a company, originally framed or altered or applied in pursuance of any previous company law or this Act.”

The objectives of the Articles of Association, as outlined in Section 5 of the Companies Act, 2013, include:

- Regulation of the company’s management

- Inclusion of prescribed matters as per the rules

It’s important to note that the Articles of Association do not preclude a company from incorporating additional matters or making necessary alterations to ensure the efficient functioning of its affairs.

Licence under section 8(1) of the Companies Act, 2013

License Details:

- Issued under section 8(1) of the Companies Act, 2013

- Pursuant to rule 20 of the Companies (Incorporation) Rules, 2014

- License Number: 146473

🏢 Company Information:

- Name: YOGENDRA SANGALE SOCIAL FOUNDATION

- Intended as a company under the Companies Act, 2013, for promoting specified objects under section 8(1)(a) of the Act

- Intention to apply surplus or other income solely for promoting objects, prohibiting dividend payments to members

Main Topics:

- Company Incorporation

- Promotion of Objects

- Dividend Prohibition

- Remuneration Guidelines

- License Revocation

Honored with Certificate of Incorporation

Yogendra Sangale Social Foundation takes immense pride in announcing its certification by the Government of India, Ministry of Corporate Affairs. This certification, issued by the Central Registration Centre, attests to our organization’s legal status and compliance with the Companies Act, 2013 (18 of 2013).

Understanding the Certification:

The Certificate of Incorporation, issued pursuant to the Companies Act, 2013 and the Companies (Incorporation) Rules, 2014, signifies the formal establishment of Yogendra Sangale Social Foundation as a corporate entity. It confirms our status as a Company limited by shares, reinforcing our commitment to transparency, accountability, and legal compliance.

Key Details of Certification:

- Date of Incorporation: July 27, 2023

- Corporate Identity Number (CIN): U88900PN2023NPL222690

- Permanent Account Number (PAN): AABCY7107L

- Tax Deduction and Collection Account Number (TAN): PNEY05004G

Significance of Certification:

The certification by the Ministry of Corporate Affairs underscores Yogendra Sangale Social Foundation’s commitment to organizational excellence and governance. It serves as a testament to our adherence to regulatory standards and ethical practices, instilling confidence among stakeholders and partners.

Honered by EMPLOYEES’ STATE INSURANCE CORPORATION

📄 Address and Contact Information:

- Sub-Regional Office:

- Employees’ State Insurance Corporation

- Panchdeep Bhawan, Plot No. P-4, MIDC Area, Triambak Road, Satpur, Nasik-422007, Maharashtra

- M/s. Yogendra Sangale Social Foundation, Karjat, 414403, C-11

- Sub-Regional Office:

📝 Subject of Communication:

- Implementation of the E.S.I. Act, 1948

- Registration of Employees of Factories and Establishments under Section 1(5) of the Act

🔍 Key Points from the Communication:

- The ESI Act, 1948 is applicable to all factories/establishments within the area where a specific factory/establishment is situated.

- The provisions of the Act have been extended to other establishments in the area.

- Factories/establishments must register themselves under the Act and ensure their employees are registered and contributions are paid.

- Establishment’s coverage under Section 1(5) of the Act is effective from 27-07-2023, subject to earlier coverage if revealed.

- Immediate steps are requested for registration of employees, submission of declaration forms, payment of contributions, and maintenance of records.

NGO Darpan Registration

Registered with the Registrar of Companies, this NGO operates under the umbrella of Private Sector Companies (Section 8/25). The registration number, U88900PN2023NPL222690, underscores its adherence to the legal framework outlined by the Companies Act of 2013. This regulatory compliance ensures transparency, credibility, and accountability in its endeavors.

Anchoring Roots: City and State of Registration

Ahmadnagar, nestled in the state of Maharashtra, serves as the city of registration for this NGO. This geographical anchoring not only signifies its local presence but also highlights its commitment to serving the community within its vicinity. Operating within the regulatory framework of Maharashtra ensures alignment with state-specific regulations and policies.

Timeline of Establishment: Date of Registration

The date of registration, 27-07-2023, marks the inception of this NGO’s journey towards fulfilling its mission and vision. It symbolizes the culmination of efforts, dedication, and perseverance in navigating the registration process. With a firm foundation laid, the NGO embarks on its quest to create a positive impact and effect meaningful change.

REGISTRATION OF THE ENTITIES FOR UNDERTAKING CSR ACTIVITIES

In a letter dated 04-04-2024, the Office of the Registrar of Companies formally acknowledges the registration of the Yogendra Sangale Social Foundation for undertaking Corporate Social Responsibility (CSR) activities. This approval underscores the organization’s commitment to social welfare and community development.

Official Confirmation: Registration Details

The registration number assigned to the Yogendra Sangale Social Foundation for its CSR initiatives is CSR00070875. This unique identifier serves as a reference point for all future communication regarding CSR-related matters. It solidifies the foundation’s legal standing and eligibility to engage in impactful CSR endeavors.

UDYAM REGISTRATION CERTIFICATE

The Udyam Registration Number assigned to the Yogendra Sangale Social Foundation is UDYAM-MH-01-0155750, marking its formal recognition as an enterprise dedicated to fostering positive change and sustainable development.

80G Certificate

An 80G certificate is a document issued by the Income Tax Department of India under Section 80G of the Income Tax Act. This certificate is provided to individuals or organizations who make donations to specified charitable institutions or funds. It allows the donor to claim a deduction from their taxable income for the amount donated, thereby reducing their overall tax liability.